October 2025

| Date | Title |

|---|---|

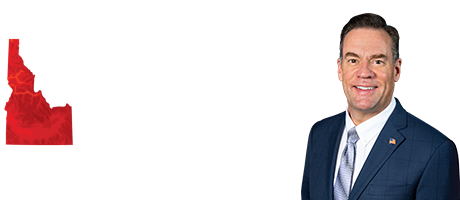

| 10/17/25 | Fulcher Announces October Telephone Town Hall Details |

| 10/2/25 | Fulcher: My Offices Remain Open, Despite Federal Government Shutdown |

September 2025

August 2025

| Date | Title |

|---|---|

| 8/21/25 | Fulcher Reintroduces ‘One Subject At A Time Act’ Ahead of Fiscal Year Deadline |